State Tax Setup

The State Tax Setup screen is used to set up the tax table for individual states.

Menu Path: Controls, System, Tax Setup, State Tax Setup, State Tax Setup screen

One table per state exists. Values in this table override the defaults from the System Tax Defaults screen. All setups from the System Tax Defaults screen display on each State table.

State Taxability Tables

State Table

Displays two alphanumeric characters of the geo code, which link to the rate tables using the geo code. Click the button to display the 'Browse States' window to search for a state. A 'State Table' must be set up in the Tax Rate Setup screen before creating a 'Rate Table' for this state.

Effective Date

Indicates the effective date of the state tax table. Click the arrow to display a calendar to edit the date.

Description

Displays a description of the state table of up to 60 alphanumeric characters.

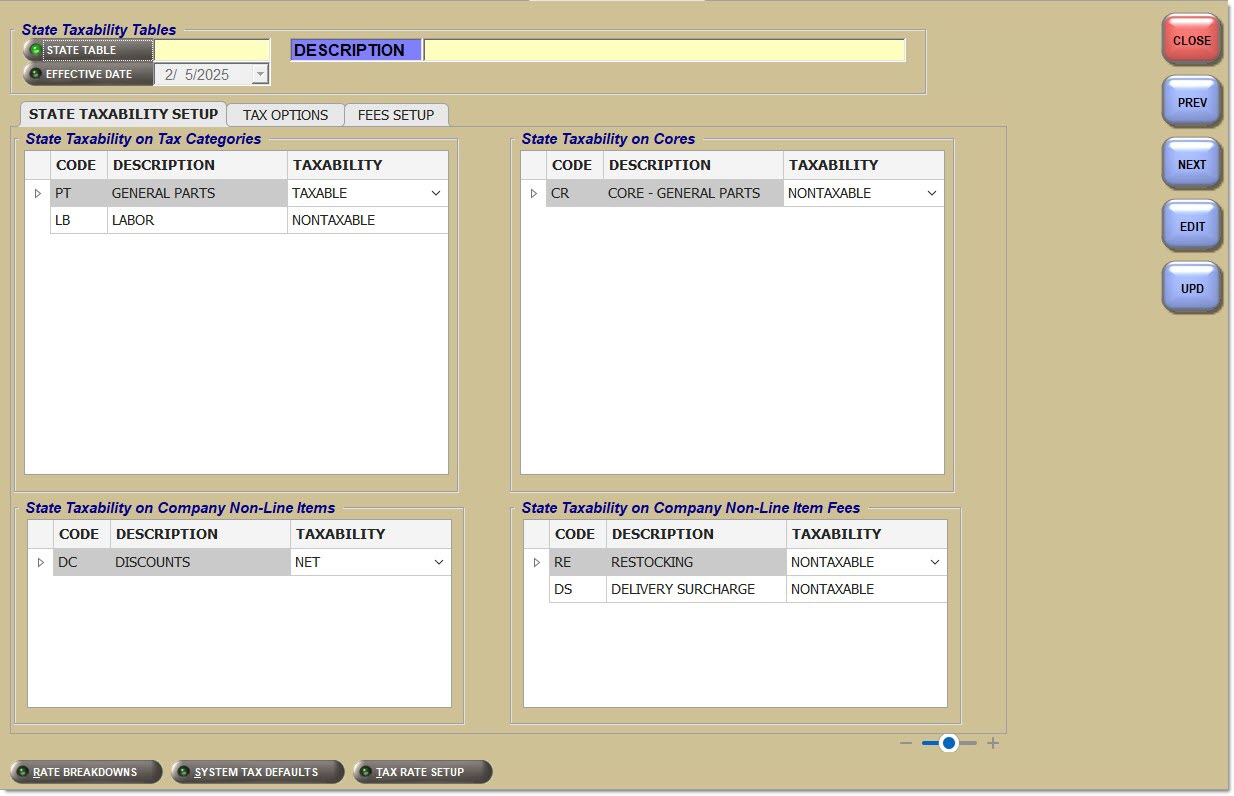

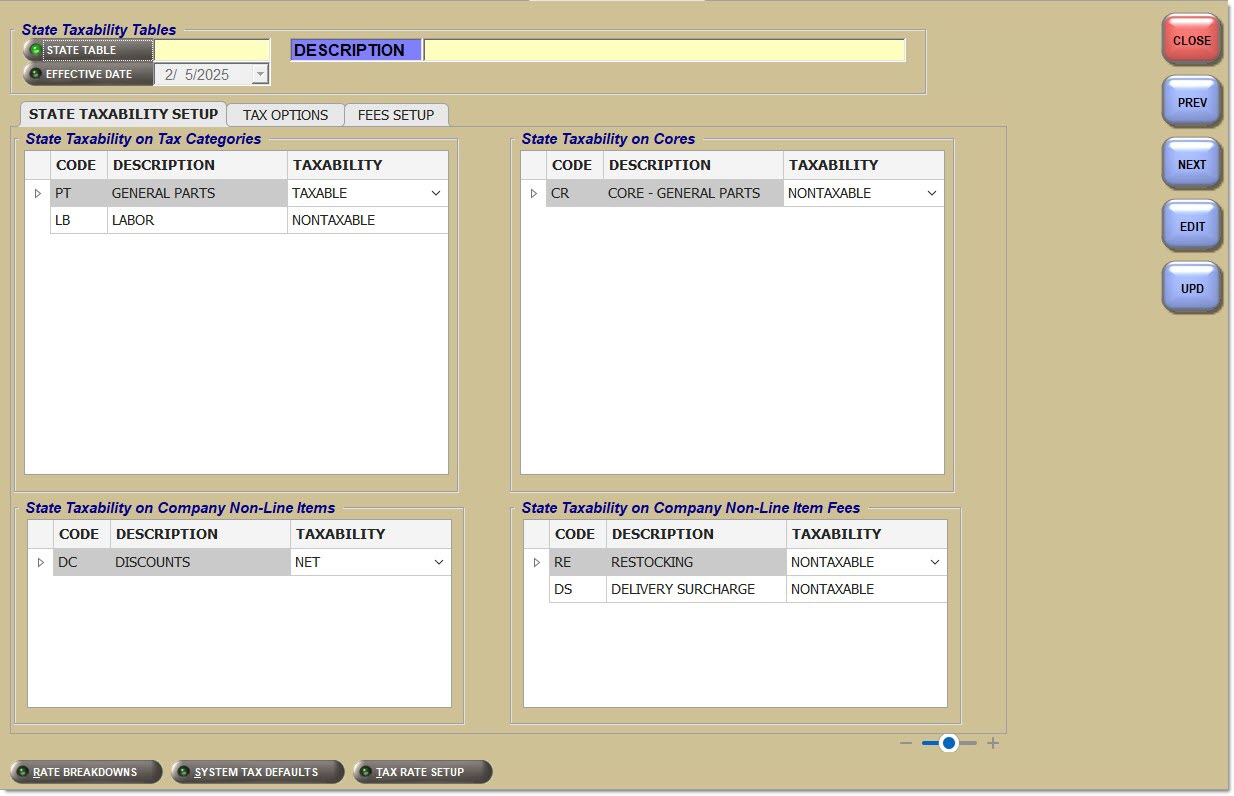

State Taxability Setup Tab

State Taxability on Tax Categories / on Cores / on Company Non-Line Items / on Company Non-Line Item Fees

Displays the Code from the System Tax Category Setup screen.

Displays a description of the tax category code.

Indicates the type of taxability.

Types are:

-

Parts - Taxable / Non-Taxable

-

Core - Tax In - Tax Out / Non-Taxable / Tax In - No Tax Out

-

Non-Line Items - The item determines the values. This list is subject to change.

Tax Options Tab

Indicates whether or not a penny break table is available in the Tax Rate Setup screen for this state.

Lowest Tax

Controls which authorities are available in the Tax Rate Setup screen for this state. Defaults to 'Use All'.

Indicates the type of decimal rounding used by a store for tax calculation at Point-of-Sale.

Options are:

-

'4 Decimal' - Rounds tax to 4 decimal places at Point-of-Sale per part type (e.g., parts, core, labor, freight, fees) per taxing authority (e.g., state, count, city)

-

'2 Decimal' - Rounds tax to 2 decimal places and stored for reporting purposes. (The invoice sums the same values as stored; therefore, the tax reported will always balance to the tax collected.) (Default for new tables.)

The field is editable. Changes go into effect after midnight based on the 'Effective Date' selected when the 'Upd' button is clicked.

Tax After Promo Coupon

When checked, the taxes for an invoice are calculated after the value of Promo Tender Coupons is subtracted.

When unchecked, the taxes for an invoice are calculated before the value of Promo Tender Coupons is subtracted.

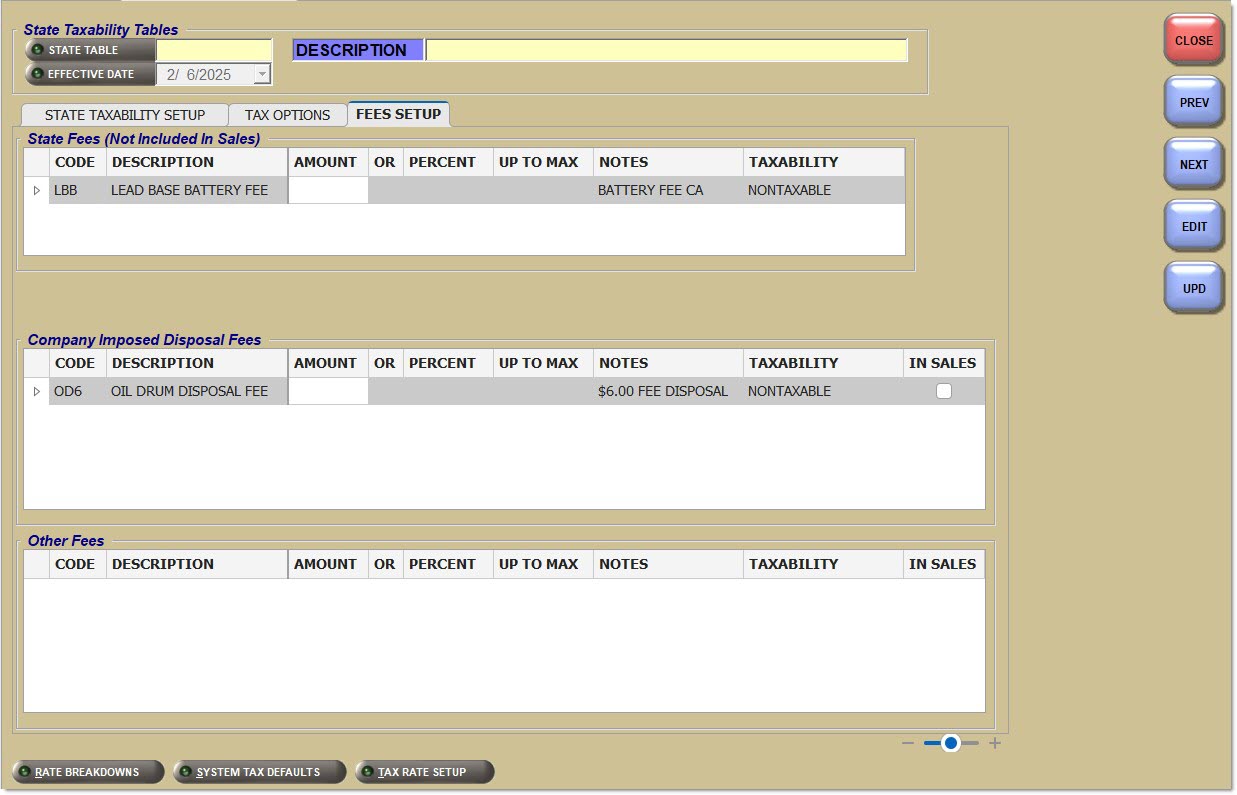

Fees Setup Tab

Used to set up State Fees (Not Included In Sales), Disposal Fees, and Other Fees rates. These can be by an amount, a percent or a percent up to a certain amount. These fees override the defaults set up in the System Tax Defaults screen. Hazmat on part record is not associated with a sales taxability and is used for reporting purposes only.

State Fees (Not Included In Sales) / Company Imposed Disposal Fees / Other Fees

Code

Displays the code from the System Tax Category Setup screen.

Description

Displays a description of the tax category code.

Amount

Indicates the amount of the fee.

Percent

Indicates the percentage of the fee.

Up To Max

Indicates a percent up to a set amount.

Notes

Indicates descriptive comment regarding the fee.

Indicates the type of taxability.

Types are:

-

Parts - Taxable / Non-Taxable

-

Core - Tax In - Tax Out / Non-Taxable / Tax In - No Tax Out

-

Non-Line Items - The item determines the values. This list is subject to change.

Indicates whether a transaction is included in corporate sales figures.

Options are:

-

'Yes'

-

'No'

Note: Used for Disposal Fees and Other Fees only; excludes State Fees, which are not included in sales.