Tax Rate Setup

The Tax Rate Setup screen is used to set up tax rate tables. States can have multiple rate tables.

Menu Path: Controls, System, Tax Setup, Tax Rate Setup, Tax Rate Setup screen

![]() Editing Sales Tax Rates - 5 minutesEditing Sales Tax Rates - 5 minutes

Editing Sales Tax Rates - 5 minutesEditing Sales Tax Rates - 5 minutes

Tax Tables

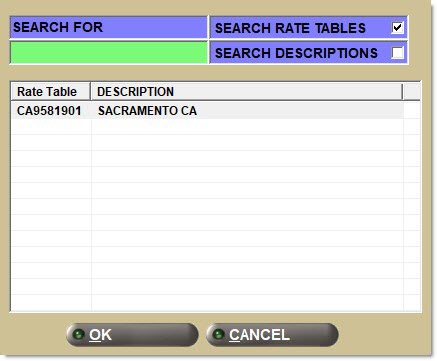

Displays the name of Rate Table. Click the button to display the 'Browse Tax Rate Tables' window to search for a specific rate table.

Rate Table number is nine alphanumeric characters, XX12345XX.

XX = State Table # (links to State Table)

12345 = Zip Code

XX = Geo Code

Note: A 'State Table' must be set up in the State Tax Setup screen before creating a 'Rate Table'.

-

'Search Rate Tables' - When this box is checked, anything entered in the 'Search For' field will have the application search the rate tables for matching records.

-

'Search Descriptions' - When this box is checked, anything entered in the 'Search For' field will have the application search the rate tables' descriptions for matching records.

-

Both fields checked - When both fields are checked, the application searches through both the rate tables and the rate tables' descriptions in order to identify matching records.

Note: When a checkbox is unchecked, the check will toggle to the previously unchecked box, ensuring one box is always checked, and allowing for both checkboxes to be checked at the same time.

Description

Displays a description of up to 86 alphanumeric characters of the 'Rate Table'.

State Table

Displays the 'State Table' number. Does not open the table.

Set Effective Date

Indicates the date that changes become effective. When no date is entered, changes are effective as soon as the 'Upd' button is clicked. The old table is kept for historical reporting.

Displays the penny amount that must be charged, as required by individual states. Penny breaks are only used in states that have one taxing authority. Table is not visible or in effect when 'Use Tax Penny Break' is disabled in the State Tax Setup screen for this Rate Table's state.

Tax Rates By Taxing Authority

Indicates if the taxing authority is used or not. When 'No', taxing authority is not used and no tax is charged.

Displays the entered taxing authority.

Taxing authorities always display on every rate table in the following order:

-

'State'

-

'County'

-

'City'

-

'Other'

Indicates the entered tax type name for the taxing authority.

Parts

Indicates the part tax rate. Any values entered echo across all breakdowns. Allows for four decimals (XX.XXXX).

Labor

Indicates labor tax rate. Allows for four decimals (XX.XXXX).

Food

Indicates food tax rate. Allows for four decimals (XX.XXXX).

Clothing

Indicates clothing tax rate. Allow for four decimals (XX.XXXX).

Tax % Total

Displays the total percent updated by the program.