Invoice Journal

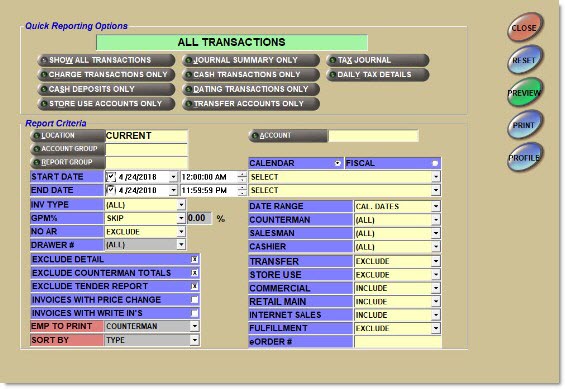

The Invoice Journal Reports screen is used to generate various Invoice Journal reports that report summaries of every transaction that is printed as an invoice.

Menu Path: Reports, Financial, Invoice Journal, Invoice Journal Reports screen

![]() Salesman and Counterman Reporting - 8 minutesSalesman and Counterman Reporting - 8 minutes

Salesman and Counterman Reporting - 8 minutesSalesman and Counterman Reporting - 8 minutes

Quick Reporting Options

Show All Transactions

Reports all transactions, detail and summary. The 'All Transactions Report' is also produced as part of the End of Day process. Both the 'Cash' and 'Charge' columns of the report will be populated.

Charge Transactions Only

Reports all transactions, detail and summary, for charge accounts only. Only the 'Charge' column of the summary page populates; the 'Cash' column does not have any values. Uses the same format as the 'All Transactions Report'.

Store Use Accounts Only

Reports all transactions, detail and summary, for store use only accounts. Uses the same format as the 'All Transactions Report'.

Cash Deposits Only

Reports all transactions, detail and summary, that are cash deposits only. Uses the same format as the 'All Transactions Report'.

Tax Journal

Reports the taxes collected on sales or credited on returns. Report is summarized as cash or charge transactions. Uses the same format as the 'All Transactions Report'.

Journal Summary Only

Reports journal summary of transactions only. Excludes detail. Reports single and multi-store locations and provides counterman totals.

Cash Transactions Only

Reports all cash transactions, detail and summary, for cash accounts only. Only the 'Cash' column of the summary page populates; the 'Charge' column does not have any values.

Dating Transactions Only

Reports all transactions, detail and summary, for dating transactions only.

Transfer Accounts Only

Reports transactions for Transfer Accounts only.

Daily Tax Details

Reports invoice and tax information for all transactions for each day in the reporting period.

Report Criteria

Location

Filters the report by the selected specific store(s). Click the button to display the 'Browse Locations' window. Allows multi-location selection only if the 'Journal Summary Only' button has been clicked. Displays 'Current' if current store is selected. Displays selected store if a single store other than current is selected. Displays 'Multiple' when more than one location (but not all locations) is selected. Displays 'All' when all locations are selected.

Account

Filters the report by the selected account. Click the button to display the 'Find Account' window.

Account Group

Filters by Account Group. Click the button to display the 'Browse Account Groups' window to search for an Account Group(s).

Report Group

Filters by Report Group. Click the button to display the 'Browse Report Groups' window to search for a Report Group(s).

Multi-Location

Indicates the type of multi-location report. Selections are:

-

'Summary' - Reports all selected locations reported as single values on a single summary page. The report header reads 'All Transactions - Multi - Location Summary'.

-

'Comparative' - Reports selected locations under each other on a single page for easy comparison. The report header reads 'All Transactions - Multi - Location Comparative'.

-

'Consecutive' - Reports each location separately with all stores totaled at the end. The report header reads ALL T'All Transactions - Multi - Location Consecutive'.

Available only when 'Journal Summary Only' in the 'Quick Reporting Option' section is selected. Not available for single stores.

Include MTD

Includes both one-day values (Today) and month-to-date values for each Tax Authority based upon the date selected in the report output, when checked.

Includes the taxes collected on sales or credited on returns for each Tax Authority for which the store collects taxes in the report output, when unchecked.

Available only when 'Tax Journal' in the 'Quick Reporting Option' section is selected.

Start Date

Specifies the start date and time to report data. Click the small down arrow to display a calendar. Click the desired date to select. Use the small left and right arrows to display previous/next months. Transactions created or submitted within the date range display. Enter a check mark in the field to report sales for a certain period. Displays all transactions, when unchecked. Defaults to current date.

Automatically populates with the appropriate date when a 'Calendar' or 'Fiscal' option is selected in the respective 'Select' field.

When saving as a profile, using the relative date option is recommended rather than selecting dates from the pop-up calendar. If the profile is saved with a fixed date range, then whenever the report is run using the saved profile, the report's output always contains the same information for that fixed date range only. If the profile is saved with a relative date range, the dates included are adjusted based on when the report is run.

End Date

Specifies the end date and time to report data. Click the small down arrow to display a calendar. Click the desired date to select. Use the small left and right arrows to display previous/next months. Transactions created or submitted within the date range display. Enter a check mark in the field to report sales for a certain period. Displays all transactions, when unchecked. Defaults to current date.

Automatically populates with the appropriate date when a 'Calendar' or 'Fiscal' option is selected in the respective 'Select' field.

When saving as a profile, using the relative date option is recommended rather than selecting dates from the pop-up calendar. If the profile is saved with a fixed date range, then whenever the report is run using the saved profile, the report's output always contains the same information for that fixed date range only. If the profile is saved with a relative date range, the dates included are adjusted based on when the report is run.

Calendar

Uses Relative Calendar dates, when selected. Works in conjunction with the 'Start Date' and 'End Date' fields.

Fiscal

Uses Relative Fiscal dates, when selected. Works in conjunction with the 'Start Date' and 'End Date' fields.

Inv Type

Filters by a specific invoice type.

Options are:

-

'All'

-

'Chg' (Charge Invoice)

-

'Csh' (Cash Invoice)

-

'COD (All)' - Reports paid and unpaid CODs.

-

'COD-Paid' - Reports paid CODs.

-

'COD-Unpaid' - Reports unpaid CODs. Note: To view all unpaid CODs, select 'COD-Unpaid' and uncheck 'Start Date' to include all dates.

-

'Dat' (Dating Invoice)

-

'Dep' (Deposit Invoice)

-

'Xfr' (Transfer Invoice)

-

'Und' (Undo Invoice)

-

'Payment Edit' (Payment Edit Invoice) - Reports only edited invoices in the detail sections, followed by the 'Payment Edit Invoices' section of the Invoice Journal detail Report. If a 'Payment Edit' is completed, the 'Payment Edit' appears in a separate 'Payment Edit Invoices' section, following the 'Undo Invoices' section.

GPM%

Filters by a specific Profit Margin.

Options are:

-

'Skip' - Shows all Profit Margin percents.

-

'< Less Than' - Shows only transactions that fall below an entered percent.

-

'= Equal' - Shows only transactions that are equal to an entered percent.

-

'> Greater Than' - Shows only transactions that are above an entered percent.

-

'<> Not Equal' - Shows only transactions that are not equal to the entered percent.

%

Indicates the percent amount of the profit margin.

No AR

Determines whether accounts with 'Account Control' of 'No AR' are reported.

Options are:

-

'Exclude' (Default)

-

'Include'

-

'Only'

Exclude Detail

Excludes detail (listing of each invoice by date) from the generated report, when checked.

Exclude Counterman Totals

Excludes counterman totals page from the generated report, when checked. Includes counterman totals page, when unchecked.

Exclude Tender Report

Excludes the 'Cash Tender Report', when checked. Available when the 'Inv Type' field is 'All' or 'Csh'. Available for single store reporting only.

Invoices With Price Change

Reports only transactions that have had price changes at the time the invoice was created. Price Change reports under OS (overstrike). Note: OS reports the number of times parts are edited. Multiple edits to the same part on a sales order counts as one (1) edit.

Invoices With Write Ins

Reports only transactions with parts that are not in the user’s inventory file (NIF or Write-In parts), when checked. Write-In reports under WI.

Emp to Print

Prints the employee type on the Invoice Journal Reports.

When 'Counterman' is selected, report the counterman who initiated the invoice. The column header is 'Ctr'.

When 'Cashier' is selected, report the cashier who finalized the invoice. The column header is 'Cshr'.

When 'Salesman' is selected, report the salesman associated with the account. The column header is 'Sls'.

Note: If there is no salesman assigned to the account in the Main Account Entry screen, the column will be blank.

Note: This setting is only available when running an 'Invoice Journal Report' including detail, via the unchecking of the 'Exclude Detail' checkbox.

Date Range

Reports transactions based on dates.

Options are:

-

'Cal. Dates' (using calendar dates)

-

'Close Dates' (end of period close dates)

Counterman

Reports only the transactions created by a single counterman.

Salesman

Reports transactions for all salesmen, by default. Can be set to only report the transactions for a single salesman.

Cashier

Reports transactions for all cashiers, by default. Can be set to only report the transactions for a single cashier.

The cashier is the employee who finalized the sales order reference.

Note: All employees will be listed in the 'Cashier' drop-down, regardless of whether or not they are designated as a 'Cashier' at the Employee Setup screen.

Transfer

Determines whether accounts with 'Account Type' of 'Transfer' are reported.

Options are:

-

'Include' (Default)

-

'Exclude'

-

'Only'

Store Use

Determines whether accounts with 'Account Type' of 'Store Use' are reported.

Options are:

-

'Exclude'

-

'Include' (Default)

-

'Only'

Determines whether commercial accounts are reported.

Options are:

-

'Exclude'

-

'Include' (Default)

-

'Only'

Determines whether retail main accounts are reported.

Options are:

-

'Exclude'

-

'Include' (Default)

-

'Only'

Internet Sales

Determines whether Internet sales are reported.

Options are:

-

'Include' - Reports Internet sales. (Default)

-

'Exclude' - Does not report Internet sales.

-

'Only' - Only reports Internet sales.

Fulfillment

Determines whether fulfillment orders are reported.

Options are:

-

'Include' - Reports fulfillment orders.

-

'Exclude' - Does not report fulfillment orders. (Default)

-

'Only' - Only reports fulfillment orders.

Field displays only when the B2C system appswitch is enabled.

Filters by the eOrder number for the order placed online.

Sorts the report by Type, Account or Counterman.

Type (default) sorts by 'Date'/'Charge'/'Cash'/'Invoice Number'.

Account sorts by 'Date'/'Account'/'Invoice Number'.

Counterman sorts by 'Date'/'Counterman'/'Invoice Number'.

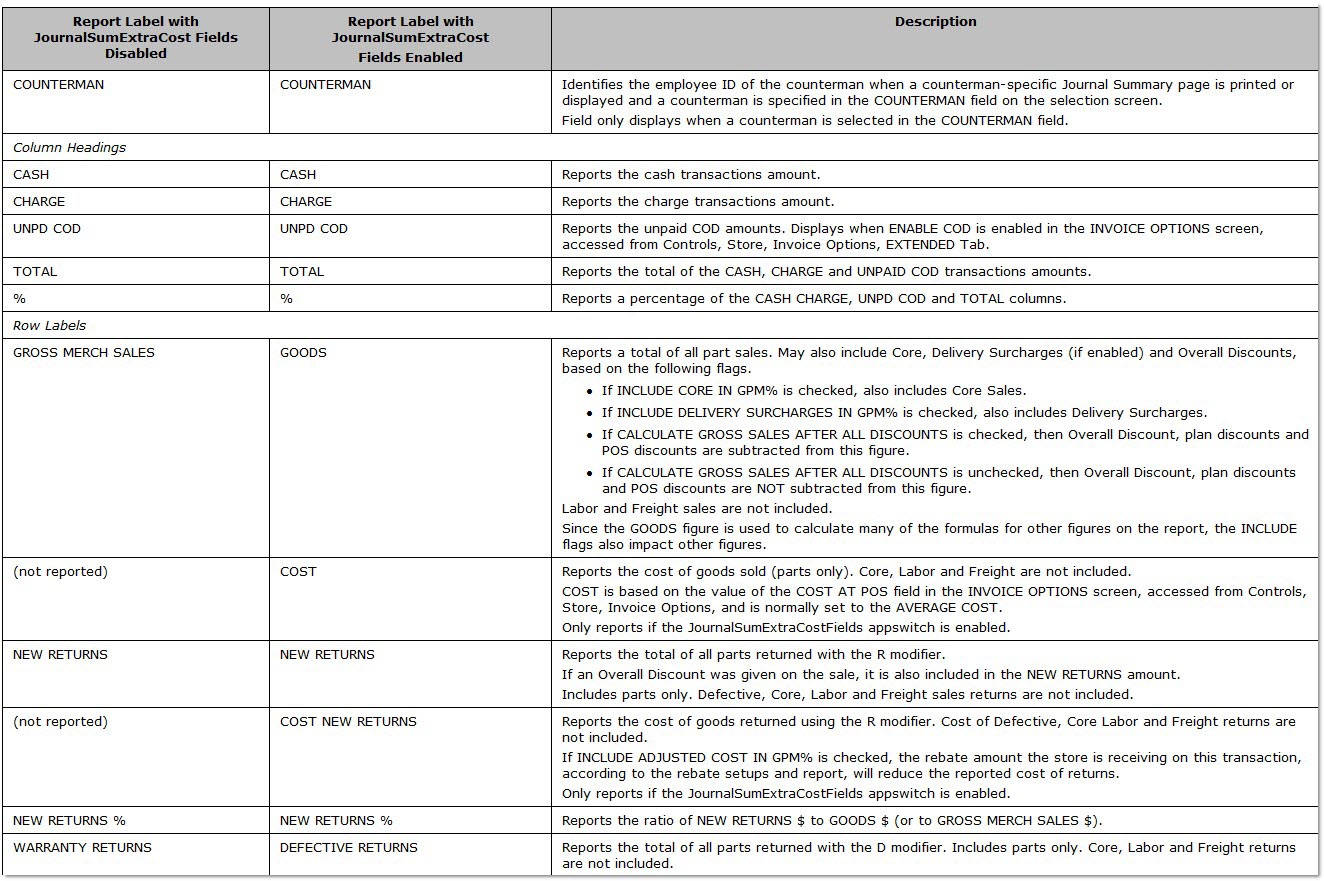

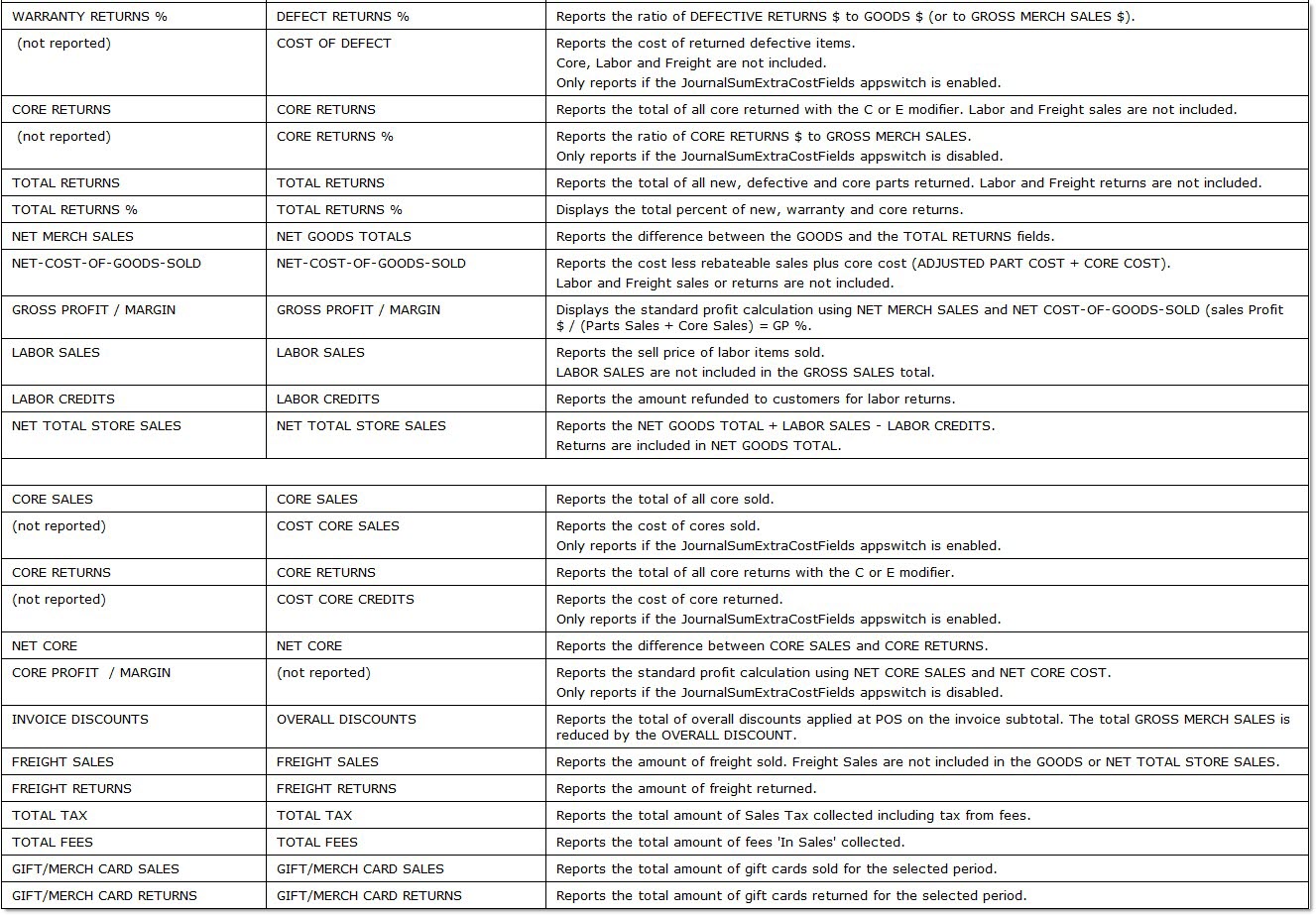

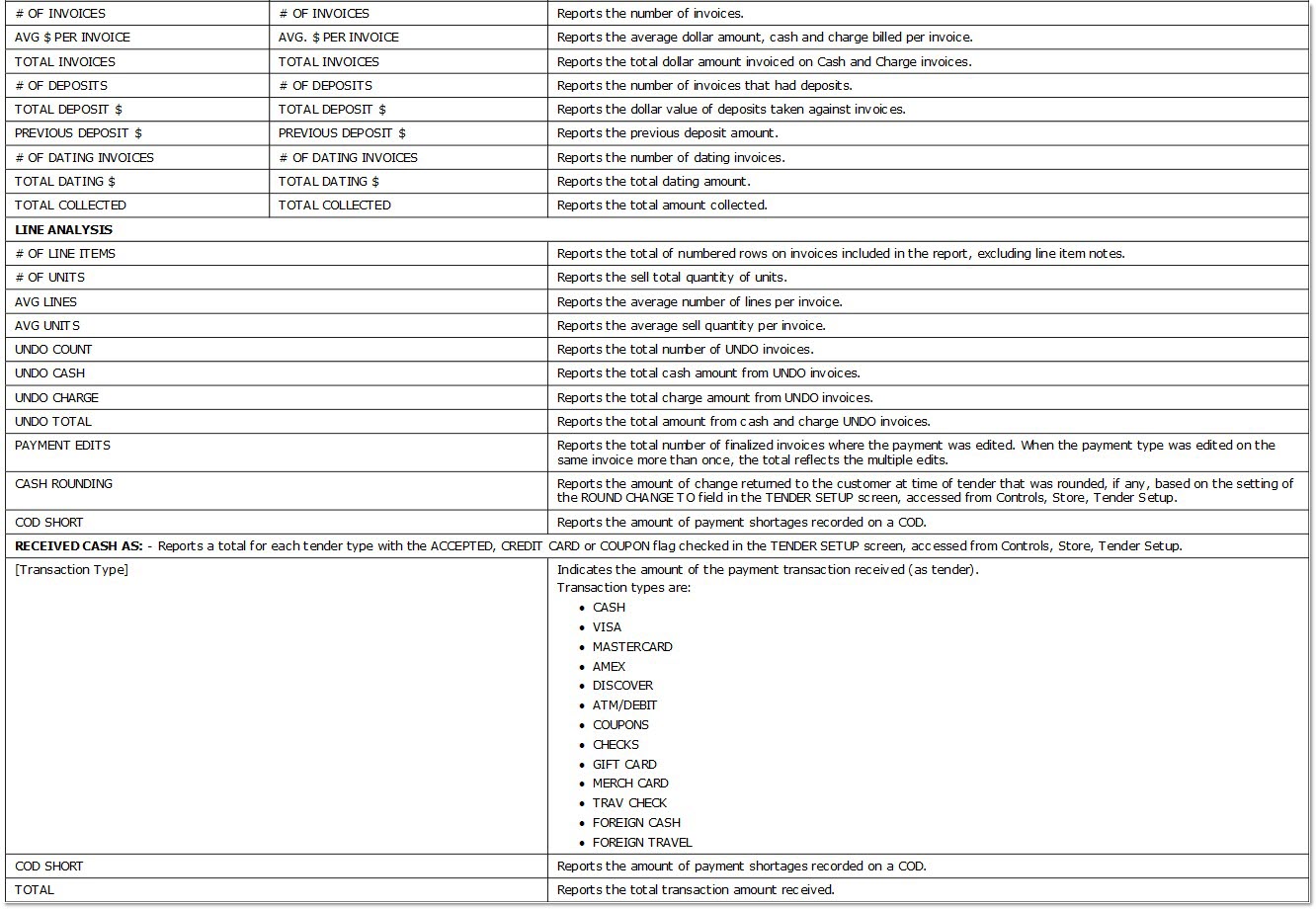

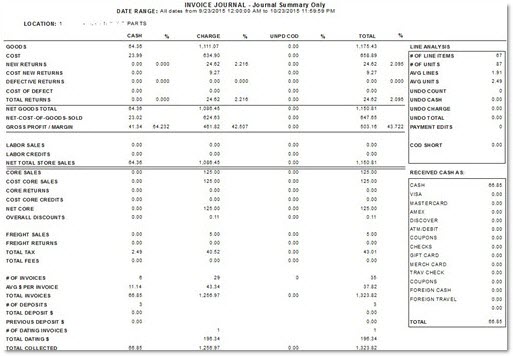

Journal Summary Page

All Journal report options, except 'Tax Journal' and Daily 'Tax Details', provide a summary page with totals of all selected invoices. The JournalSumExtraCostFields appswitch determines the row/field name that display. The following identifies the row/field name that displays when the appswitch is enabled and disabled.

The following is an example of the 'Invoice Journal - Journal Summary Only' of the 'All Transactions Report', with the JournalSumExtraCostFields appswitch enabled.

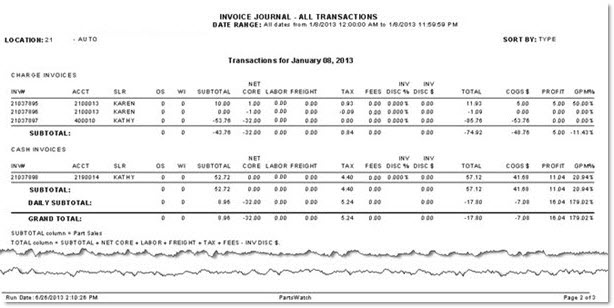

Daily Report

When running any report option, except 'Tax Journal' or 'Daily Tax Details', and the 'Exclude Detail' flag is unchecked, a detail section of the journal reports after the Summary page, listing each invoice by date. Invoices are grouped by type, such as Cash, Credit, Transfer, Cash Deposit, Deposit Void. Note: The 'OS' column reports the number of times parts are edited. Multiple edits to the same part on a sales order counts as one (1) edit. For example, if the column reports '3' edits, then a price change was made to three (3) different parts, not three (3) edits to the same part.

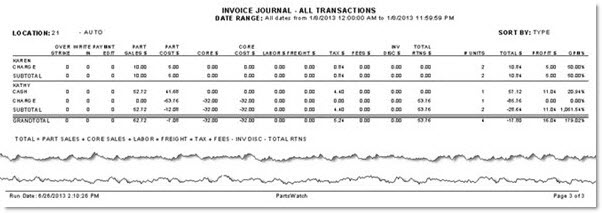

Counterman Totals Report

When running any report option, except 'Tax Journal' or 'Daily Tax Details', and the 'Exclude Counterman Totals' flag is unchecked, a section reports after the detail page, listing invoice totals for each counterman.

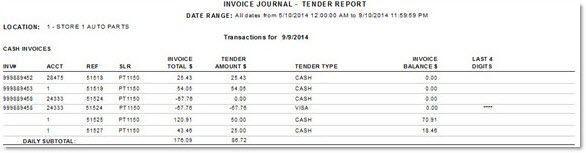

Tender Report

The 'Tender Report' lists all invoices reported in the 'Invoice Journal Cash Invoices section of the Invoice Journal. Only 'Cash' and 'Deposit' invoices paid with tender, such as cash, checks and credit cards, are included in the report. Invoices that are considered 'Charge' (finalized as On Account) and 'Unpaid COD' are not included in the report. The form of payment(s) processed on each invoice is listed to allow the user to view the single or multiple forms of payment applied to each invoice. For credit and debit card transactions, the last four (4) digits of the card are also reported. The report is grouped by the transaction date and sorted by invoice number.

If more than one tender transaction was processed on one invoice, as in a split payment, the additional 'Tender Amount $', 'Tender Type', and 'Last Four Digits' display in the next row. If two different payment transactions occur using the same tender type on the same invoice, the transactions list on two different rows. For example, an invoice paid with two 'VISA' credit cards with two different credit card numbers display on two rows.

The 'Exclude Tender Report' checkbox determines if the 'Tender Report' is included with the Invoice Journal.

The following is an example of the Tender Report.

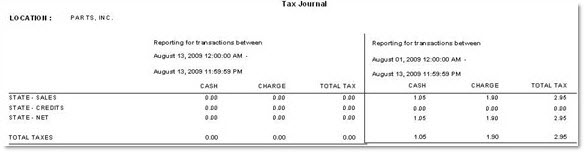

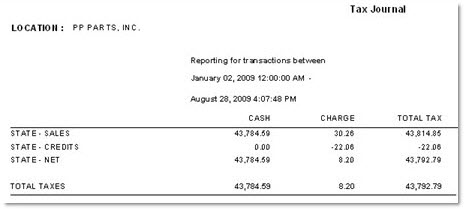

Tax Journal Report

The 'Tax Journal Report' displays taxes collected on sales or credited on returns.

The following is an example of the 'Tax Journal Report' (when the 'Include MTD' field is checked).

The following is an example of the 'Tax Journal Report' (when the 'Include MTD' field is unchecked).

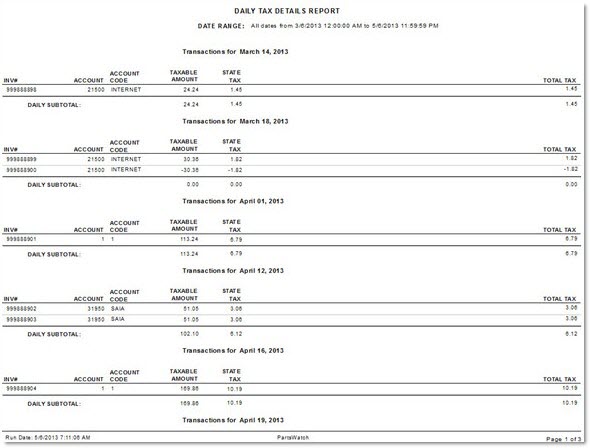

Daily Tax Details Report

The 'Daily Tax Details Report' lists invoice and tax information for all transactions for each day in the reporting period. Each day is subtotaled separately. Multiple days are listed one after the other followed by a grand total of all the days.

The following is an example of the 'Daily Tax Details Report'.