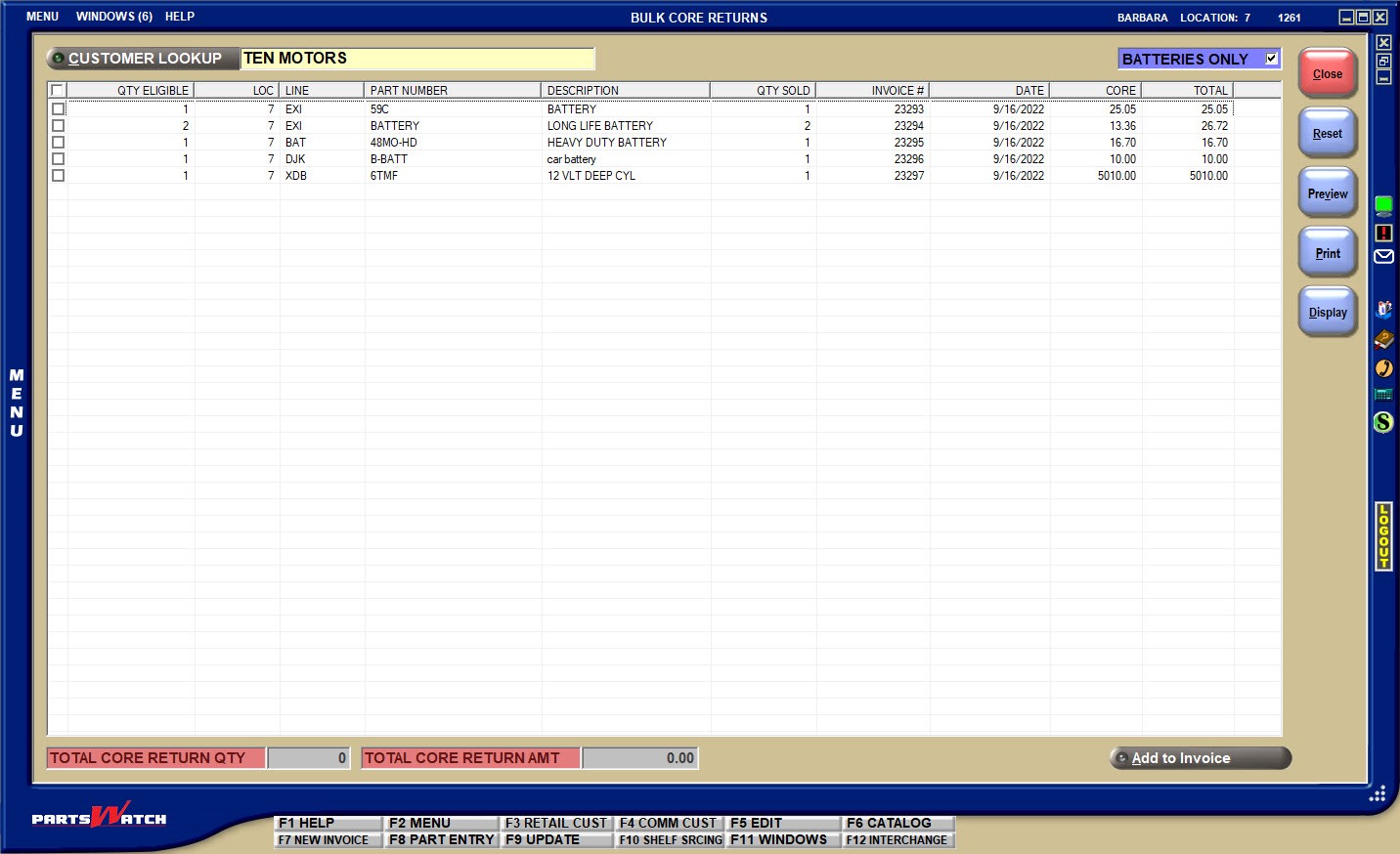

Bulk Core Returns

The BULK CORE RETURNS screen is used to quickly and easily create core return invoices when the customer returns a large number of cores from various original sale invoices.

Menu Path: Invoicing, Bulk Core Returns, BULK CORE RETURNS screen

Enter a valid wholesale or retail customer in the 'CUSTOMER LOOKUP' field or click the 'CUSTOMER LOOKUP' button to select one. Press the Enter key or click the 'Display' button and the screen grid displays all eligible outstanding core, not yet returned, for the customer.

The grid defaults to display battery core only. Uncheck the 'BATTERIES ONLY' field and the grid will display all eligible core returns, or leave it checked for batteries only.

Note: An eligible return is one that has not already been returned and one that was sold within the number of days specified in the 'NEW RETURNS VALID DAYS' setting field.

The taxability of bulk core returns is based on the tax rules in place at the time of the return, not based on any edits to the original sale.

To return all core displayed, check the small checkbox in the grid header or check only the rows to include in the return.

The quantity being returned and the amount of return increases / decreases in the 'TOTAL CORE RETURN QTY' and 'TOTAL CORE RETURN AMT' fields below the grid as the rows are checked / unchecked.

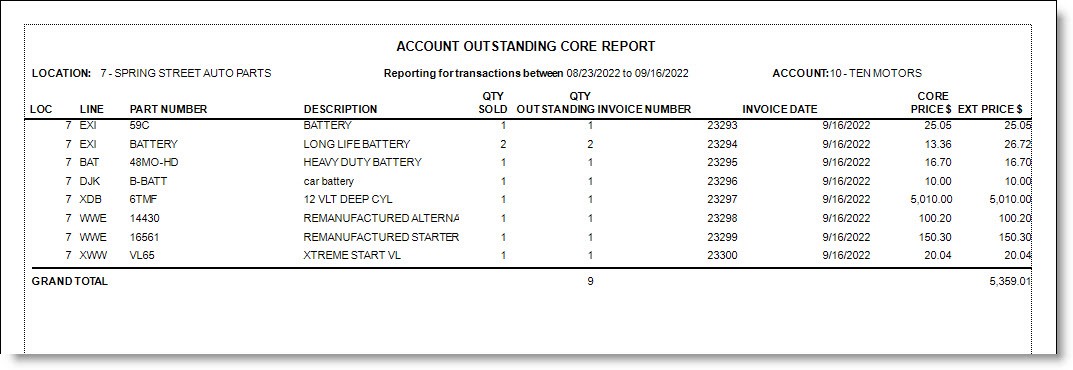

'Preview' or 'Print' the Account Outstanding Core Report to output a report of all core displayed in the grid, regardless whether a row is checked or unchecked. Use the 'BATTERIES ONLY' field to filter the output by all core or battery core only.

The report shows the location of the sale, the core 'LINE', 'PART NUMBER', 'DESCRIPTION', 'QTY SOLD', and the 'QTY OUTSTANDING' which is the quantity not yet returned. It also reports the 'INVOICE NUMBER', 'INVOICE DATE' (date sold), 'CORE PRICE $' (core price), 'EXT PRICE $' (extended price = quantity outstanding * core price) and totals the extended price.

For multi-stores, if the customer shops in more than one store, the list includes all returns regardless which store the sale was made in, depending on Employee settings on the EMPLOYEE SETUP screen.

When done selecting core for return, click the ‘Add To Invoice’ button below the grid and the INVOICE screen opens with the invoice grid populated with the selected returns.

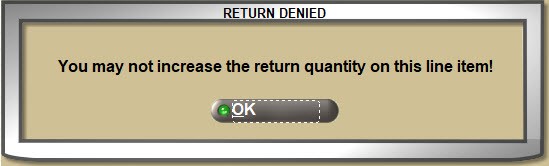

Depending on the settings on the USER SECURITY SETUP screen, Core 'SELL', 'CORE', 'DESCRIPTION' and taxability are editable; however, return quantities cannot be increased in the INVOICE screen. To return additional quantities of the core, add it as a return on a new line.

If a core is returned to the sell line and the quantity increased, the system prompts:

Note: The taxability of bulk core returns is based on the tax rules in place at the time of the return and is not based on any edits to the original sale.

Once a core is added to an invoice from the BULK RETURNS screen, the BULK CORE screen closes and all existing invoicing functionality continues to edit and finalize the invoice.

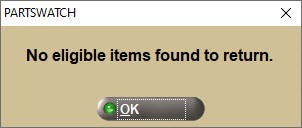

If no eligible core sales are found for the customer entered, the system prompts:

Click ‘OK’ to close the popup and click the 'Reset' button to refresh the screen to enter another customer.